“Wow, is this really true??….

“Wow, is this really true??….

A recent article by Doug Henschen in InformationWeek (see full text below) mentions a prediction from Gartner that indicates CMO’s will outspend CIO’s on technology by 2017. Even if this prediction is anywhere near true, it would be amazing and really shows the influence that digital marketing and associated analytics technologies are having on this space. Marketers are now truly learning the immense benefits associated with properly tracking and extracting value out of multi-channel marketing data. CMO’s can now use technology to analyze what channels are working best to attract specific customer segments and how one marketing channel leads to engagements on other related channels. So today you can now track who is engaging on your social media channels and also navigating to your web properties to learn more about your products or make purchases. What all this means of course is that marketers will need to form even tighter relationships with the IT teams at the organizations where they work, to bring all the pieces together. There will need to be hardware to host all the digital marketing tools, likely deployment of big data platforms like Hadoop to store and process all the data, then the hosting and maintenance of the associated data integration and marketing analytics tools required to extract value out of all this multi-channel marketing data. Marketing will need to work closely with IT to get this infrastructure in place, but there will be challenges when blending the two worlds due to communication and prioritization issues. Marketers will need help bridging this gap to make sure that their requirements are being understood, the right tools are deployed to meet their specific needs, and new incremental functionality is being rolled out in a rapid Agile fashion. The role of the marketer is evolving rapidly with the associated expansion in responsibilities and the requirement for a new level of integration with other teams like IT.

The good news is that these are exciting times for marketers, now we just need to hope that these new investments are spent wisely on quickly extracting customer insights from this data in a matter of weeks, not months, or years….”

Article: Why CMO Tech Spending Is Good For IT

As CMOs increase their tech spending, it’s up to IT to get wise to marketing’s ways.

Doug Henschen on Big Data

February 04, 2013

By now, most CIOs have heard the Gartner prediction that chief marketing officers will outspend CIOs on technology by 2017. Whether or not you agree with that prediction, there’s no question that marketers are now influential technology buyers, even if they’re not taking swaths of responsibilities away from CIOs.

The onslaught of interactive marketing and digital commerce — starting with the Web and email and more recently venturing into mobile and social interactions with customers — is behind much of this technology spending. It has also put marketers under pressure to reconsider how they measure, manage and execute marketing across traditional channels, whether print, TV, radio, in-store, Web or call center.

Technology is finally doing to marketing what it did to financial markets two decades ago: driving it toward automation and real-time analysis, says marketing strategist David Meerman Scott, author of The New Rules of Marketing & PR.

On the automation front, specialized workflow systems with supporting asset management and collaboration features are helping marketers develop and execute campaigns at scale and with the speed demanded by fast-moving consumer trends. Analytics is bringing more precise measurement and, hopefully, better planning and smarter decision-making, both within individual marketing channels and across channels, letting companies adjust their investment mix for maximum impact.

Too many marketing organizations have been underinvesting in technology, relying instead on manual tracking using spreadsheets and email. But those old ways are breaking down given the demand for scale and speed. The future of marketing is going to be “much less art and much more science,” says Meerman Scott.

The science relies on analytics, requiring plenty of data. This should be welcome news to IT pros, who are in the best position to help with the inevitable data management challenges. But CIOs “can’t just wait for CMOs to say, ‘Please help us,'” warns John Kennedy, VP of corporate marketing at IBM.

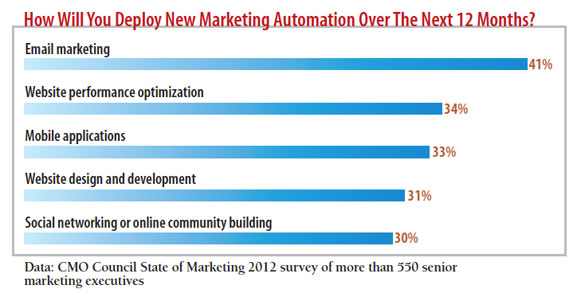

Only 10% of 550 marketing execs surveyed by the CMO Council put a priority on improving collaboration with their IT organizations this year, despite the fact that 43% of them plan to hire marketing or customer analytics talent, 41% plan to deploy email marketing automation and a third plan to deploy website performance optimization and mobile apps. If marketing and IT teams don’t work together, this marketing tech spending won’t reach its full potential. “CIOs have a role to play at all levels of marketing, particularly in aligning the technology so it can scale,” Kennedy says.

Understand Marketing’s Needs

One of the problems is that CIOs often don’t get how the CMO role has changed. “The marketer’s role has expanded from just driving demand and sales,” Kennedy says. “Now they’re also creating content, customer experiences and customer engagement” through Web, mobile and social channels.

IT leaders must map what marketing does these days to the emerging technology that backs various functions. The three main categories of marketing management systems, as defined in Gartner’s Magic Quadrant, are CRM-based multichannel campaign management (MCCM), integrated marketing management (IMM) and marketing resource management (MRM). Automation and analytics show up in all three categories.

MCCM systems are used for such processes as managing loyalty-card programs and promotional content. Their decision-support capabilities let companies quickly change inbound and outbound marketing offerings. IMM systems track a project from start to finish: from developing marketing concepts and allocating resources (money and people) to creating, testing and executing campaigns and evaluating results and feeding that analysis back into the next concept-development phase. MRM systems have supported strategy and planning. They’re now moving into operations by incorporating creative workflow management, asset management and fulfillment capabilities for the logos, videos and other materials used in marketing campaigns.

IBM was among the first big tech vendors to jump into marketing technology when it acquired Coremetrics (Web analytics) in 2010, followed in short order by acquisitions of Unica (MCCM and MRM), Sterling Commerce (e-commerce) and, in 2012, DemandTec (marketing analytics) and Tealeaf (customer experience analysis). Adobe acquired Web analytics vendor Omniture in 2009, expanding into MCCM. Teradata acquired Aprimo (MCCM, IMM and MRM) in 2010. SAS acquired Assetlink (MRM) in 2011.

Salesforce.com has focused on the social channel with its 2011 acquisition of Radian6 (social analytics) and Buddy Media (social marketing). Last year, Microsoft acquired MarketingPilot (IMM and MRM) and Infor acquired Orbis Global (MRM).

In the latest big marketing tech deal, Oracle announced in December plans to acquire Eloqua, which does MCCM. Competitors are downplaying Oracle’s $871 million deal as mostly focused on business-to-business marketing, but Oracle could easily extend and integrate Eloqua’s technology with its other assets to address consumer marketing, says Forrester analyst Rob Brosnan. Combined with other Oracle cloud apps such as Oracle Fusion CRM, Eloqua has the makings of a fresh replacement for Oracle’s aging Siebel CRM platform, Brosnan says.

IT teams must understand the five groups within marketing organizations and the key technology investments they’re making, Forrester contends. The list starts with CMOs at the top and then moves down to brand marketers, marketing operations, relationship marketers and interactive marketers (see below). Analytics is on the list at every level, and automation is needed at every level below the CMO.

| What Marketing Technology Buyers Need | ||

| Group | Key Needs | Representative Technologies |

| CMO and other marketing leadership | Focus on all aspects of marketing. Key areas include measurement, strategy and marketing optimization. | > Marketing performance management > Marketing mix modeling > Attribution |

| Brand Marketer | Focus on building the brand and creating compelling brand content. Work with agencies, media buying firms and creative shops. | > Brand measurement > Marketing resource management (planning) > Asset management and localization |

| Marketing operations | Central organization that focuses on budgets, processes, vendor relationships and fulfillment. | > Marketing finance management > Marketing resource management (workflow) > Production and fulfillment management |

| Relationship Marketers | Emphasize customer insight development and direct communications. | > Descriptive and predictive analytics > Campaign management and marketing automation > Interaction management and contact optimization > Event-based marketing |

| Interactive marketers | Focus on digital advertising, itneractive marketing and emerging media strategy. | > E-mail, search, display, social and mobile > Web analytics and online testing > Behavioral targeting and recommendations > Audience management |

| Data: Forrester Research | ||

The Red Cross Needed Help

At the American Red Cross, much of the marketing in years past was done locally, at more than 700 chapters, with little central coordination and control. Four years ago, however, new management brought in a team from the for-profit world to build a strong headquarters-level marketing organization.

More Insights

“We wanted marketing that’s consolidated, powerful and breathtaking, but you don’t get that when your efforts are fragmented,” says Banafsheh Ghassemi, a telecom industry veteran hired as VP of marketing-eCRM and customer experience.

The Red Cross wanted consistency not only between national and chapter-based marketing, but also across channels (TV, radio, print, direct mail, Web, etc.). Consistent “omnichannel” messaging and measurement is one of the hottest priorities in marketing.

The Red Cross had a mix of manual methods, point technologies and contract relationships with agencies. It lacked a marketing management system to track campaigns and return on investment by channel; those initiatives were tracked in paper notebooks, whiteboards, spreadsheets and email messages. The charity had a Teradata data warehouse, but it lacked campaign management tools and internal know-how for marketing segmentation and targeting.

Over the last three years, the Red Cross has filled many of its marketing technology gaps. It chose Aprimo, now owned by Teradata, as its marketing management platform. The charity’s brand and creative team uses the system’s automated review and approval workflows to develop marketing programs. The field marketing team uses the system to collaborate with Red Cross chapters about those programs and related priorities, planning and resource allocation.

The Red Cross is now deploying Aprimo’s campaign management features. That deployment was delayed for 18 months because the Red Cross learned that it needed a better handle on its data before it could do customer segmentation, testing and targeting internally. The IT team discovered that not every Red Cross line of business (disaster relief, support for military families, health and safety training, blood supply and international services) was feeding data into its Teradata data warehouse, and those that were using it weren’t defining data consistently. The Red Cross ended up hiring a VP of data strategy, Disney veteran Chris Taylor, to fix the problems. Poor data quality has been the bane of business intelligence and analytics projects for decades, one reason marketing teams need to work more closely with their IT colleagues.

Another data challenge is sheer scale. “Three years ago, we didn’t have the system or even the techniques in place to keep some of the data that we now know to be significant for effective targeting and segmentation,” Bob Page, eBay’s VP of analytics platform and delivery, said during a recent CMO Council webinar. While eBay had data on its marketing — mostly email campaigns and keyword buys — and the resulting transactions, it wasn’t keeping behavioral data such as clickstreams and site search records.

“We knew what products customers bought when they checked out, but we didn’t know how often they came to the site, how long they stayed and what they looked at before they bought,” Page said. “This behavioral data helps you understand interests, impulses and motivations … but it also explodes the amount of data you have to collect.”

Most companies are reluctant to throw out marketing technologies they’ve already bought; they’d rather build on what they have than start over. This preference explains why IT vendors are acquiring or building out their marketing capabilities to create a suite of products. Swedish insurance company Folksam, for example, uses Infor’s Epiphany CRM system. Epiphany added integration to Orbis Global’s marketing resource management system last year, and then in December Infor acquired Orbis Global. Around the same time, Folksam chose to replace an aging on-premises deployment of Aprimo’s software.

Folksam started deploying Orbis’s software on premises in October, and it expects to have it in production by May. The deployment will address outbound telemarketing, inbound call center, direct mail and email marketing. Folksam handles Web campaigns using a separate system, and its social network activity is limited to monitoring customer comments.

“All of our monthly plans and budgets for campaigns are set up in Orbis, and the campaign leader sets up the customer offer and what kind of media we’re going to use — whether that’s email or direct mail,” says Staffan Magnehed, Folksam’s director of CRM. “We also have to determine what the offer is going to look like, the budget, and how many different activities we’ll have in a multichannel campaign.”

Once the campaigns are planned and prepared in Orbis, the next steps of customer segmentation, targeting and campaign execution are handled in Epiphany’s Customer Interaction Hub, which combines automation and analytics capabilities.

Banks and telecom companies in particular are getting sophisticated with their promotional offers to new customers, says Forrester’s Brosnan. Those efforts might involve targeting certain customers to receive cross-sell or up-sell offers, waiting a certain amount of time and then triggering follow-up offers depending on the customer’s response. Such marketing was a manual process in years past “and would have taken place at a direct marketing agency or marketing services provider like Acxiom or Experian,” Brosnan says.

Now that Red Cross is on its way to resolving its data quality problems, it plans to handle customer segmentation, testing and targeting using Aprimo’s campaign management tools. The Red Cross used to outsource that work to agencies. “If I can have a system in front of me that lets me play with my segmentation and do testing at my fingertips, that’s a huge time savings compared to sending emails, submitting a work order and then calling to find out when that work will come back,” Ghassemi says.

Holy Grail: Knowing What Works

As companies market across more channels, it only intensifies an age-old problem: Which ads or promotions worked to drive a sale? Marketers refer to it as “attribution.” You might know, for instance, that a customer clicked on an email offer and bought something, but did a prior direct-mail offer, a search keyword buy, a Web or print ad, or a social media interaction make that customer more receptive to the email pitch?

Attribution determines where CMOs spend their marketing dollars. In a conventional, direct-attribution approach, companies look at each channel separately, measuring response within that channel without considering other efforts. Now companies are coming up with ways to study customer-interaction histories across channels and give credit where it’s due. But this has mostly relied on crude rules applied manually or replicated within marketing management systems. For example, a system might assign a sale to the first or last marketing touch, or it might average the attribution across all marketing interactions with a given customer.

Advanced analytics hasn’t cracked this nut yet, but vendors are trying. IBM, for one, last month released an Attribution Modeler application that uses advanced algorithms to assess the impact of efforts in each channel.

Macys.com uses SAS software for attribution analysis. “You need to understand the causation and correlations between digital and offline activities so you know what’s triggering which behaviors and which activity drives the next,” says Kerem Tomak, VP of marketing analytics for the online retailer.

Did display advertising drive traffic to search and then to a website, or did the interaction start with search? Is a visit to a website a failure if a customer puts an item in a shopping cart and then abandons it, or did the customer decide to go pick up the item at one of our stores? Can individual campaigns lose money while still moving customers a step closer to a valuable sale?

Macys.com is using its attribution modeling techniques to allocate marketing budgets by channel and to determine which products are best promoted through which channels — “building a bridge,” as Tomak describes it, between marketing and merchandising decisions.

“If you track interactions, attribute correctly and test your models so you know you can trust your analysis, then you have a very powerful tool that will help you orchestrate everything you do,” Tomak says.

This Isn’t A Threat

The complexity involved in knowing how best to market to your would-be customers is only growing. Forty-four percent of store shoppers surveyed during the last holiday season said their first step was to go to a store, but 20% said they went to that retailer’s website first and 10% said they started with a general online research. That’s according to a study of more than 24,000 consumers across 100 websites, 29 retail stores and 25 mobile sites, conducted by customer experience analytics vendor ForeSee.

Among mobile buyers, 43% said their first choice would be to buy in store, but they ended up buying through a mobile app, likely because the item was out of stock or they looked at the item in store and found a less expensive option online.

In this kind of multichannel environment, marketing is a whole lot more than a brand message. It doesn’t matter if the CMO or CIO is signing the checks, companies must use technology to interact better with their customers. They need to better understand their customers so that they can respond more quickly to changing buying patterns and please customers in every interaction, be it online, on the phone or in person. As IBM’s Kennedy puts it: “How we operate can be a bigger factor than what we communicate.”

IT pros shouldn’t see these marketing trends as a threat. The Red Cross’s marketing tech initiative meant spending more on the IT side and hiring a director of data strategy. The lesson: Whether they’re supporting customers or personalizing an email marketing message, great technologists remain at the center of making sure the customer experience lives up to the marketing promise.